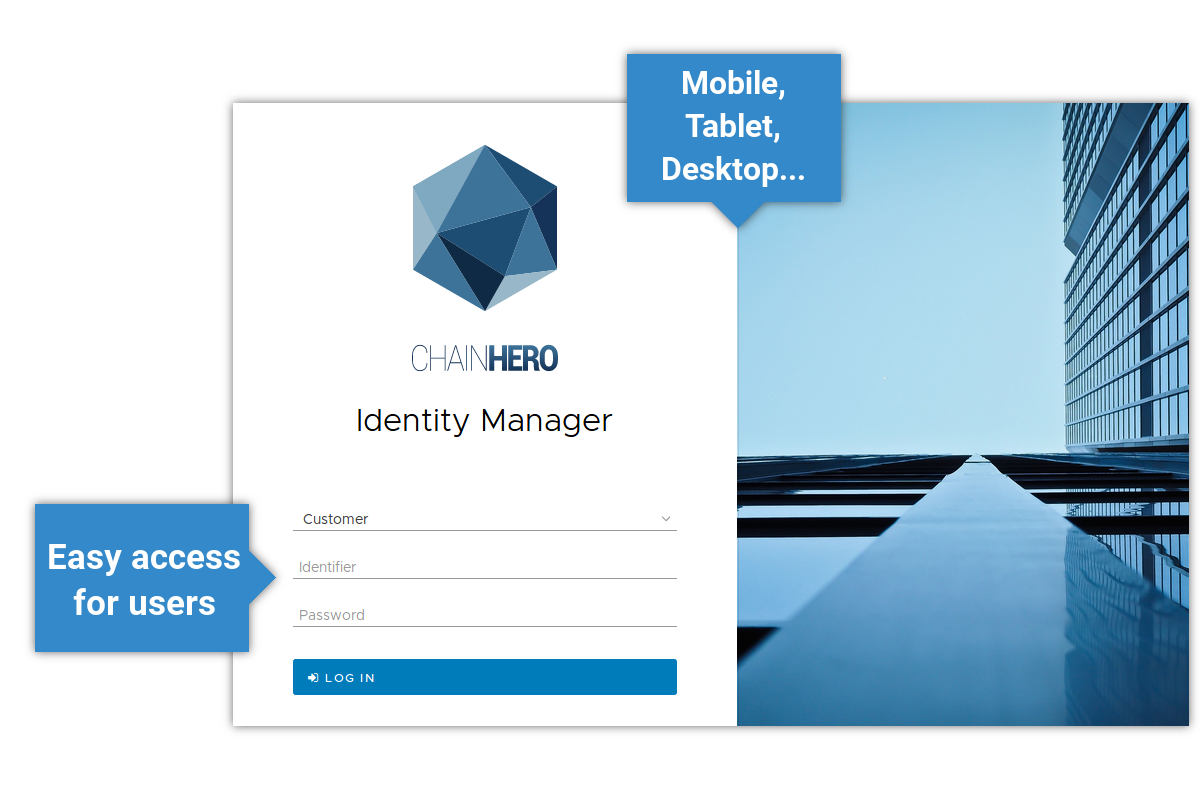

Identity Manager

chainHero makes the choice to build a new platform that help institutions,

banks or organisation, to manage customer data.

Our tool puts control of personal data back in the hands of the end user and respect regulation like the GDPR.

Reduce the cost

Today, in a financial institution, the end user needs to wait on average 24 days to be onboarded.

During this time, people from compliance department check that all informations provided by the customer are correct.

40,000,000 $

Average KYC bank spends

13,000 people

Dedicated to KYC in JP Morgan

24 days

Average onboarding time

chainHero Identity Manager is dedicated to help companies to handle their KYC regulation and especially overcome the new GDPR regulation.

Thanks to our solution companies are able to easily manage, gather customer data and prove to regulator that their whole KYC process is compliant with the regulations.

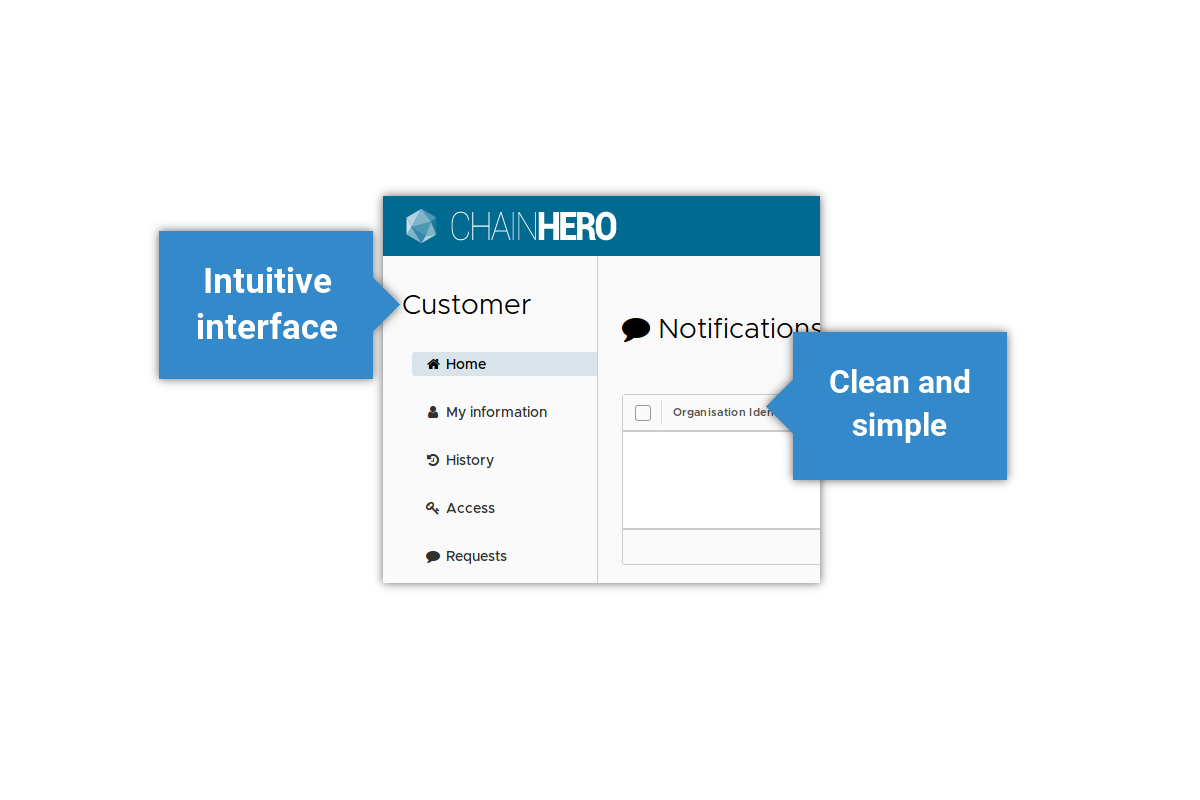

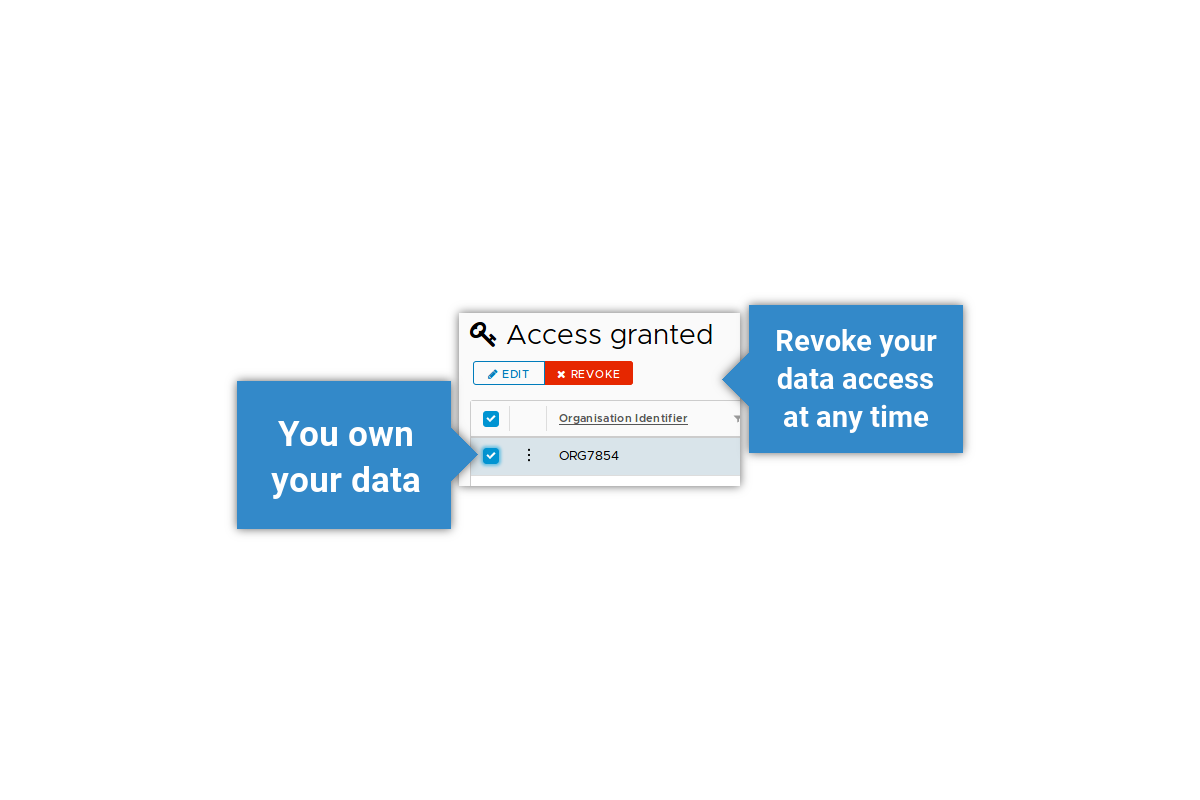

User control of personal data

Companies do not need anymore to waste time to gather customer data : it’s the end user who will share his information with them.

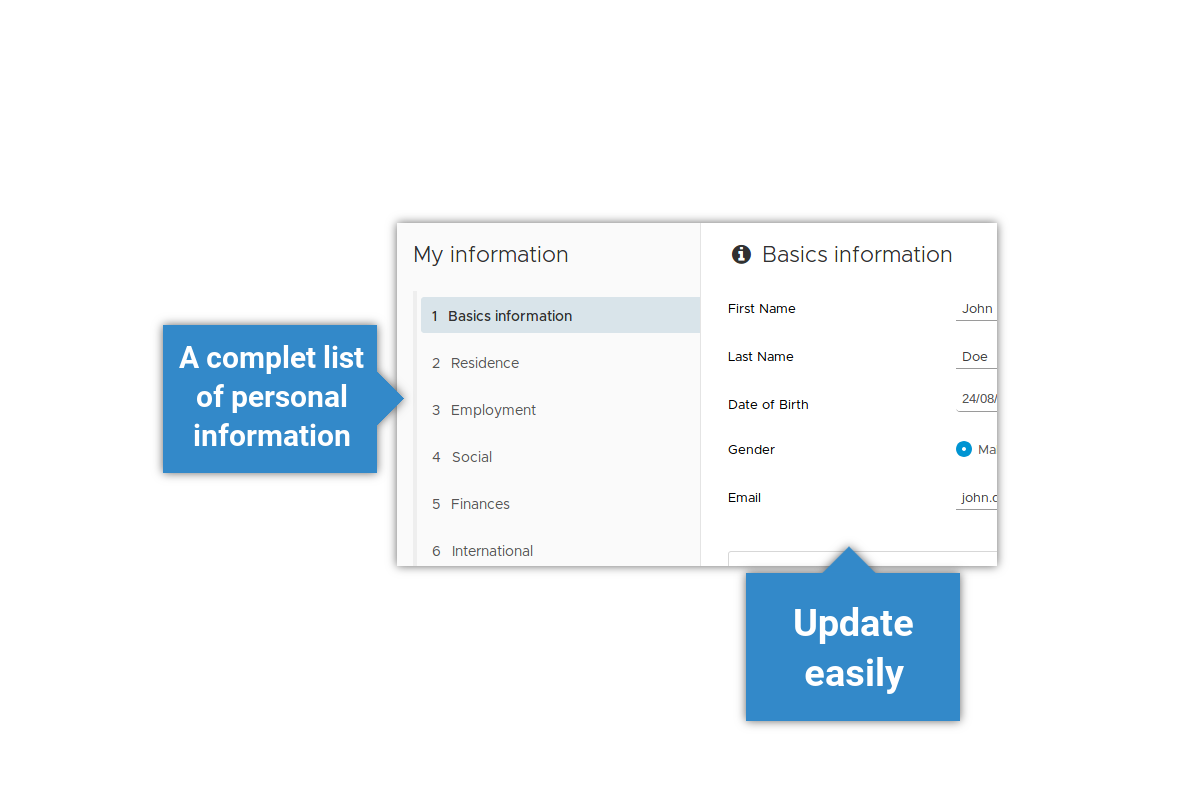

In our application, each customer can create his own, secure, safe and encrypted profile containing all the data that he may want to share with companies.

Then during each KYC process, the end user decides what he wants to share with who.

Nothing if static, during the whole customer lifetime, the company and the customer can change their agreement on which piece of data they need to honour their contract.

ChainHero puts data back in the hands of the end user.

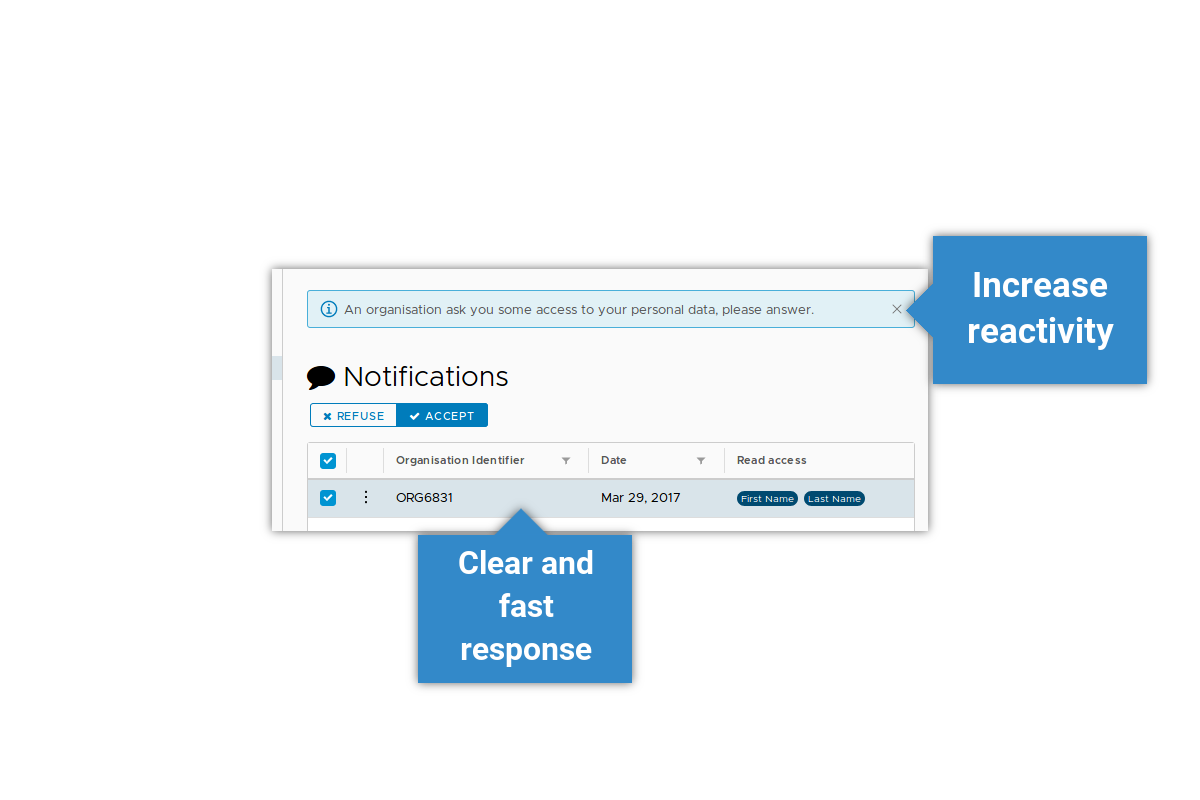

Secure and auditable

All personal data are encrypted and stored in private separated databases.

It means that only companies that have been granted to the customer data are able to read these.

So companies don’t have to care anymore about managing, monitoring, auditing these data, the system make it for them.

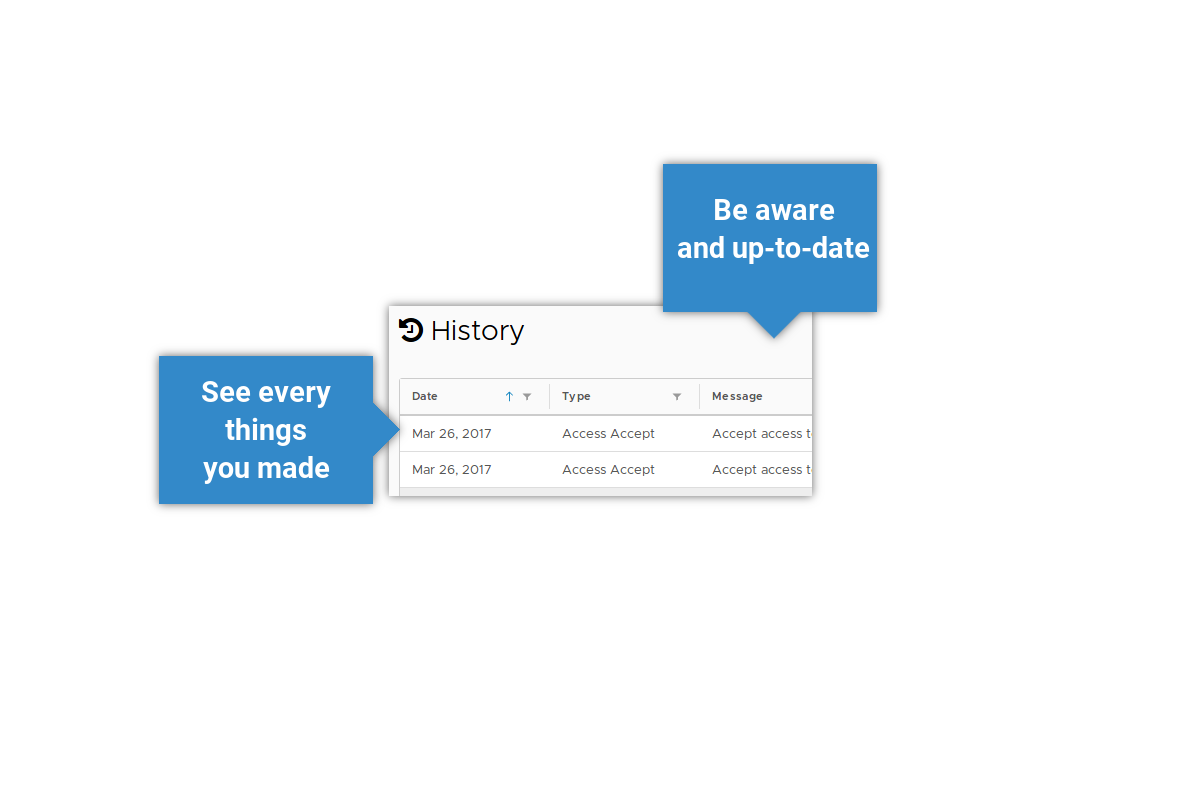

In order to facilitate audits, we stored in the blockchain the transactions, the access and the revokes of the personal data from the customer to the companies.

So this way and thanks to the blockchain immutability of data, it’s very easy for a company to prove that its KYC process is 100% GDPR and law compliant.

Our Blockchain solution regulates who can access to what and store every action made by a user: update customer information, validation of data, revocation of access…

So a regulator can easily check all this point without seeing customer information.

Win win approach

Reduce your onboarding time using our solution. If another company needs customer data that already be validated, why they need to make the validation process again.

Our Identity Manager solution offers to the company the possibility to share its validated data with its trusted partners in exchange of a commission.

That’s absolutely not mandatory but this win win approach between partners save money and time during the onboarding process.

Companies can also create department teams within our solution, and chose which customer data they need to share with them.

Companies are in total control of the data used across all their departments.

Reduce the time

Thanks to our blockchain platform, all the companies, departments, institutions are notified every time a customer, with who there is an agreement, changes his data.

There is no more wasting time of periodically checks that every customer's data in possession of the company are still valid and correct.